We believe that having the right information and knowing what your gold is worth is the most important thing to know when deciding to sell your gold. Used and second-hand industries – from pawnshops to used car lots – have a bad reputation when offering a fair price for gold and we believe this comes from the imbalance of information between dealer and seller.

The dealers often know much more about their product and it’s true value than their customer. This often results in the dealer using that knowledge to their advantage and offering the lowest price they can. If you go into a pawnshop you might expect to get a low offer and negotiate from there. So, if they initially offer you $100 and you settle on $150 you might be very happy at first… until you learn that they would have been willing to pay $300 if needed.

We want to be a different kind of business and earn your trust with transparency and honesty by always offering a fair price. Here is how we aim to do that:

- We share our payout percentages here to make it easy for you to understand our margins and “what’s in it for us”.

- We list our gold prices online for what we offer on all gold jewellery on an up to the minute basis so you are never surprised.

- There is absolutely no pressure to sell and no costs for testing to make it easy to shop around.

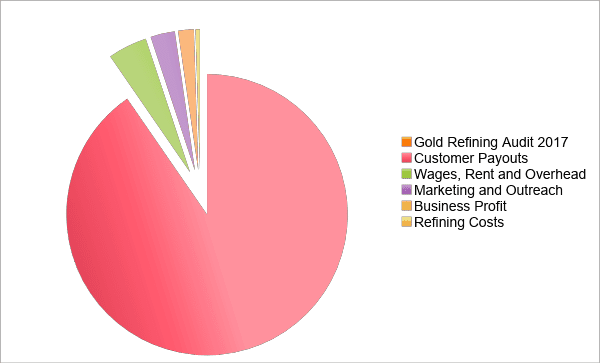

Where Does the Money Go: Our 2017 Gold Purchase Audit*:

91% – Payouts for their gold made directly to our customers. We pay a minimum of 80% on all scrap jewellery and much more for bullion, premium jewellery, and large amounts of gold. In 2017, our average payout for refined gold was 91% of the market rate of gold.

4.8% – Wages, Rent and Overhead.

2.7% – Marketing and outreach

2% – Profit

0.5% – refining cost

Our business is based off volume and we help people cash out on millions of dollars of gold every year. We strive to keep our costs as low as possible while still offering the highest level of expertise and a safe place to sell valuables.

Other businesses that pay less often have much lower volumes and much higher costs per dollar of gold they bring in.

Is Now the Right Time to Sell?

Our prices over time are based on two factors: the current market price of gold, and our percentage payout.

Market Price

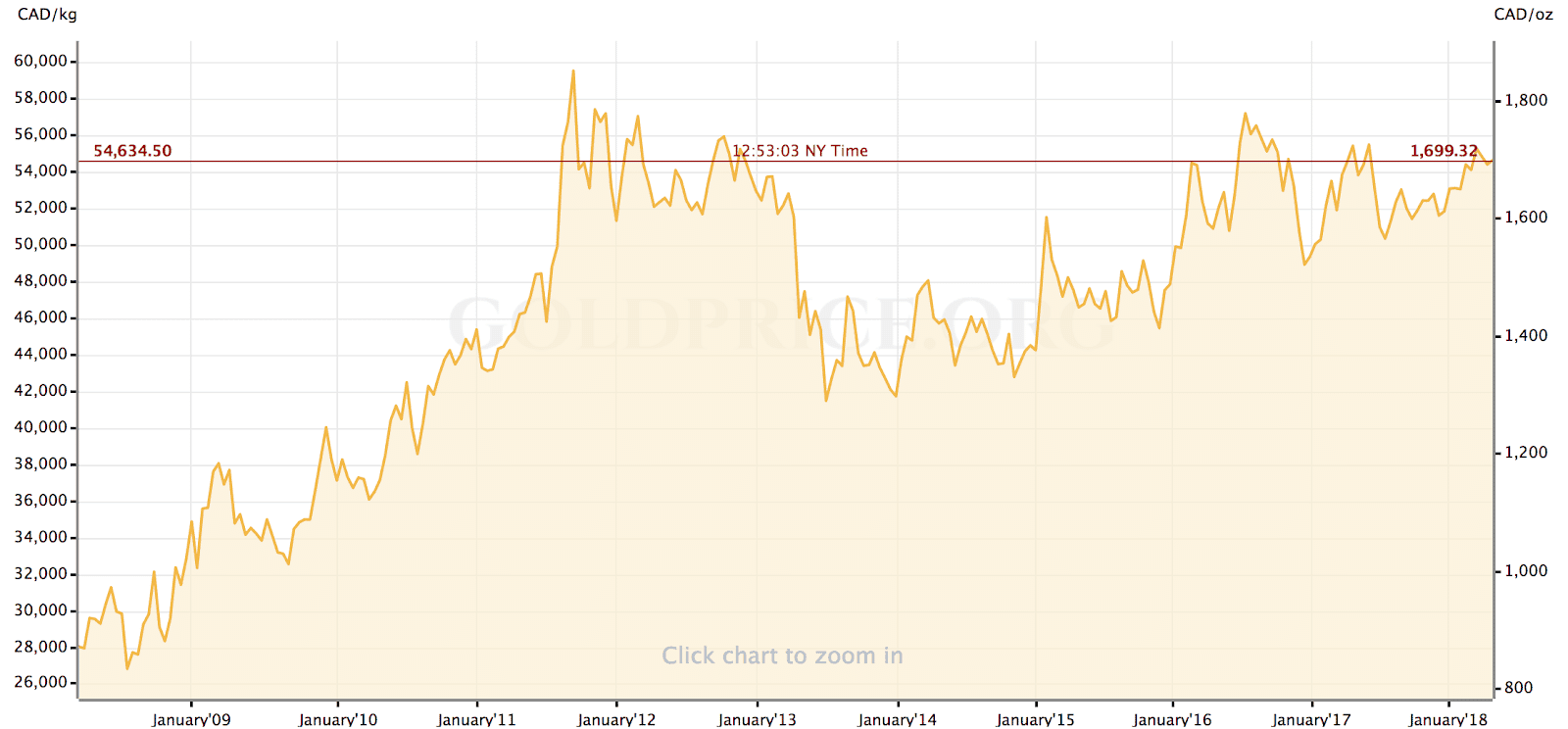

In terms of the market price for gold, as of early 2018, we are at about $1700/oz which is way above the long-term average and over 90% of the all-time high reached in 2012 of around $1800/oz. So, based on past gold prices, this is one of the best times to sell. Projecting forward is much harder and at any given moment you can find lots of varied opinions on whether gold prices and going to go up or down. We never try to time the market with our sales and refining, but we have lots of customers who keep a close eye on what’s happening with gold price to decide when to come in.

Our Payouts:

When we opened for business, gold was around $600/oz (compared to around $1700/oz as of May 2018) and our prices started at 73% of spot price for scrap gold – which was significantly over the industry average of 40%-50% offered by most local and mail-in buyers. As we have grown, higher volumes and better testing have allowed us to raise our starting and minimum prices to 80% of the market value in our gold. In addition, we now pay much higher prices for premium items such as bullion, coins, jewellery with diamonds, brand name items, and large purchases. Factoring in all gold purchases, our average cash for gold payout was 91% of spot price in 2017 – our highest payout percentage ever.

Do you pay the most?

A quick google search will find lots of articles like this one that show that most gold buyers across the industry pay between 30-60% of the market value for scrap gold. In Kiplinger.com’s post, one buyer even offered 9%! Canada Gold offers a minimum payment of 80% of the spot price of gold in Canada, and higher for bullion, premium items, and larger transactions. In many areas, our prices are the highest advertised price out there!

Obviously, the advertised price is not everything though, and what really matters is getting the highest actual offer for your gold. Differences in how the metal is tested (the composition of the gold, any subtractions for stones, etc), fees and minimums, and the occasional dishonest dealer – we recommend checking with the Better Business Bureau – make it much better to actually compare offers for your gold rather than just the listed prices (warning though – if the dealer does not list a price or won’t tell you over the phone what they pay they almost always offer very low rates). We are very confident that the offer you receive from us will be the highest, and if you do receive a higher offer we will beat that price by 120% of the difference.

Higher payouts lead to more business, more referrals, and more happy customers!

Do all items get melted down?

While most of the gold we buy does get melted down, about 5% of the items we see do actually get polished, repaired and resold. By buying gold with the intent to resell, we are able to offer higher prices for these items. We also buy and resell diamonds and bullion.

Here are some of the things we consider when determining if an item can be resold – and a premium price offered:

- Are there any diamonds in the piece? We always pay a higher amount for items with diamonds.

- Is the piece from a brand name like Tiffany or Cartier? Again, we always pay a premium for high-end brand name items.

- Is there a resale market for this item? Items that are still in style and purchased in the last few years, antique jewellery, and staples (diamond studs, eternity bands) are the most likely to fit into this category.

- How heavy is the item? While we pay a premium price for heavier jewellery, often this gold was purchased and popular when the market value of gold was much lower and the piece more affordable. Heavy jewellery (chains etc.) are usually melted downs. Smaller pieces with a high degree of craftsmanship and intricacy are more likely to be resold.

- What kind of condition is the item in? While we do repair many pieces before reselling them, this does add to our cost. Some items move from the online store to the melting pot based on condition.

If you want to get a fair price for your gold, visit one Canada Gold’s locations in Vancouver, Surrey, North Vancouver, Richmond, Hamilton, Ottawa, Calgary, Edmonton, Toronto, Ottawa, or Halifax, find one of our nearby locations here. Canada Gold is accredited with the Better Business Bureau and is an authorized DNA dealer for the Royal Canadian Mint.

*This breakdown is based on our gold purchases we refine in aggregate (so does not include items we resell like bullion or premium jewellery). Individual transactions range from payouts of 80% to 99.2% of market price. If broken out, smaller transactions would have a larger percentage of value going to wages and overhead and profit, while still returning 80% to the customer. Larger transactions paying over 91% would obviously be the opposite!