Most coloured diamonds are made synthetically because the variables necessary to form a naturally coloured diamond are extremely rare, thus why they are the most expensive kind of diamonds.

Most coloured diamonds are made synthetically because the variables necessary to form a naturally coloured diamond are extremely rare, thus why they are the most expensive kind of diamonds.

At one point in time it was very common to see circulated silver coins. On January 2nd, 1908 when Canada opened its first Royal Mint in Ottawa, the “first coin” (half-dollar) was a silver coin (92.5% silver/7.5% copper). From then until the late 1960s, Canada, much like everyone else, produced silver coins, with exception to the penny (bronze) and the five cent (nickel). But the 1960s marked the death of silver currency coins. It wasn’t just Canada, but most countries around the world were making nickel or copper-nickel coins.

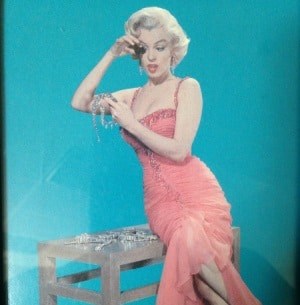

A famous Marilyn Monroe quote says “diamonds are a girl’s best friend.” Then there are some who will say that women are complicated. So does that mean diamonds are complicated too?

What’s the difference between a 1918 Canadian 50-cent coin and a 1921 Canadian 50-cent coin? Easy answer: 3 years. Informative answer: the 1921 is far rarer (suspected that only 75 exist), and is worth 25,000 times more (estimated to be worth $249,000 USD).

Ever wondered how gold is refined? Check out the five stages of metal refining according to the Royal Canadian Mint.

Just about everyone has possessions with personal or sentimental value beyond what the market might say they’re worth. When you really think about it, that’s basically how we assign value to everything; I place greater value on a cup of coffee than having a spare couple of bucks in my pocket, so I buy a coffee. The coffee shop would rather have my change than the capacity to produce one extra cup of coffee, the beauty of the free market ensues! But what about “sentimental gold”?

Not only do we buy your old gold, but we also sell it in bullion form. Learn more about investing in gold bullion in Canada in this short video.

Understanding the factors that influence the price of gold is crutial before making an investment in the precious metal. Equally important is to be aware of the key differences in the supply and demand of gold compared to other investments such as commodities, stocks and bonds.

Most people know that any gold jewelry can be sold off for its precious metal content value quite easily these days through a local cash for gold dealer. A solid piece of gold jewelry can fetch a price well beyond its aesthetic appeal due to the precious metal content or its “melt” value.

The demand for jewellery as an investment comes in large part from reputation. While there are no direct factors that link gold prices to inflation, the US dollar, or economic and political concerns, investors’ expectations – as long as enough people believe – are powerful enough to create a relationship.